On April 22, 2019, the Medicare Board of Trustees released their annual report on the status of two separate trust funds, the Hospital Insurance (HI) Trust Fund and the Supplementary Insurance (SMI) Trust Fund. The Boards of Trustee report annually on the financial operations and actuarial status of the program in a combined report that covers Medicare Part A, Part B, and Prescription Drug Coverage (Part D). The HI fund consists of Medicare Part A, helping to pay for inpatient hospital services, hospice care, and skilled nursing facility and home health services following a hospital stay. The SMI fund includes Medicare Part B and Part D. Most of the projections in the report are based on current law.

The Board of Trustees is projecting that Medicare expenditures will increase at a faster pace than worker’s earning or the overall economy in future years. In addition, the report projects that HI tax income and other dedicated revenues will fall short of HI expenditures. The Part B and Part D accounts of the SMI fund are expected to be adequately financed.

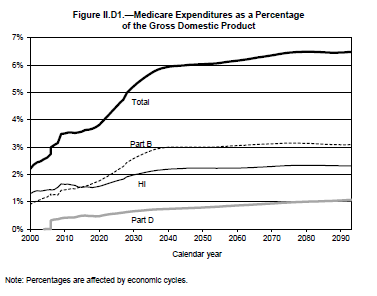

Expenditures as a percentage of GDP are expected to increase, with the rapid growth in the number of beneficiaries and the grown in health care cost per beneficiary both contributing to this. The Trustees believe that the financial projections in their report “indicate a need for substantial changes to address Medicare’s financial challenges.” As with last year, the report encourages using more efficient models of care delivery in order to compensate for a negative impact on availability and quality of care in the future. This echoes the current administration’s priority of moving to value-based care.

Hospital Trust Fund Depletion Date Remains the Same

The report estimates that the HI trust fund will be depleted in 2026, the same projected date as last year’s report. HI expenditures are expected to grow at an annual rate of 7.0 percent over the next five years. The fund again does not meet short-range financial adequacy test results, meaning the Trustees determined the HI fund is not adequately financed over the next ten years. The fund has not met this short-range test since The HI fund also failed to meet the Trustees’ long-range test.

Conversely, the report states that the SMI trust und is expected to be adequately financed over the next 10 years and beyond. This is attributed to premiums and general revenue for Medicare Parts B and D being reset each year to cover expected costs. Over the next five years, the Trustees are projecting the costs in Part B and Part D will grow significantly faster than the projected average annual GDP growth rate of 4.7 percent. Cost growth over these years is projected at an average of 8.3 percent for Part B and 7.3 percent for Part D. The Trustees note that financing for the SMI fund would have to increase faster than the economy to covered expended expenditure growth.

Long range projections as a percent of GDP are somewhat higher than those project in the report last year. The Trustees attribute this to faster projected spending growth for physician-administered drugs and slower assumed growth of economy-wide productivity. The long-range outlay projections for Part D are slightly lower than the projections in last year’s report.

For the third consecutive year, the Trustees are issuing a determination of projected excess general revenue Medicare funding because the difference in outlays and dedicated financing sources is projected to exceed 45 percent of outlays within 7 years. Since this determination was made in the last year’s report as well, a Medicare funding warning is triggered, which requires the President will have to submit to Congress proposed legislation responding to this warning within 15 days of the submission of the Fiscal Year 2021 Budget. Congress will then have to consider the legislation on an expedited basis.