Momentous changes are coming to Medicare’s Part D program that will reshape the landscape of out-of-pocket (OOP) prescription drug costs for beneficiaries. Starting January 1, 2025, the Inflation Reduction Act (IRA) will introduce a $2,000 OOP cap on Part D costs for Medicare beneficiaries. Additionally, the new Medicare Prescription Payment Plan, sometimes referred to as the M3P, will allow enrollees to spread their OOP costs over the plan year, instead of paying upfront at the pharmacy. Although implementation of these policies is complex and affects many stakeholders, they have the potential to improve patient access to medications by increasing medication adherence and improving affordability.

A New Cap on Out-of-Pocket Expenses

The OOP cap is a key component of the broader redesign of the Part D program under the IRA. This redesign eliminates the coverage gap, also known as the donut hole, and fundamentally changes how Medicare beneficiaries manage their drug costs. In 2025 the OOP cap will be $2,000, but over time that amount will be adjusted for inflation and will not remain static at $2,000.

This cap is expected to bring substantial relief to beneficiaries who struggle with high prescription costs. However, it’s important to recognize that policy changes in healthcare often have complex ripple effects, sometimes resembling a game of whack-a-mole—addressing costs in one area can lead to increases in another. Within the context of broader changes to the Part D benefit, there may be mixed outcomes for beneficiaries. While the OOP cap and M3P have the opportunity to greatly benefit enrollees, their impacts do not happen in a vacuum. There is concern that enrollees might face higher Part D premiums resulting from higher plan liability for drug costs above the spending cap, though the IRA includes guardrails to stabilize premiums. On the other hand, this places increased financial pressure on plans who may address this pressure by increasing use of utilization management or other approaches like increasing utilization of generic drugs.

Introducing the Medicare Prescription Payment Plan

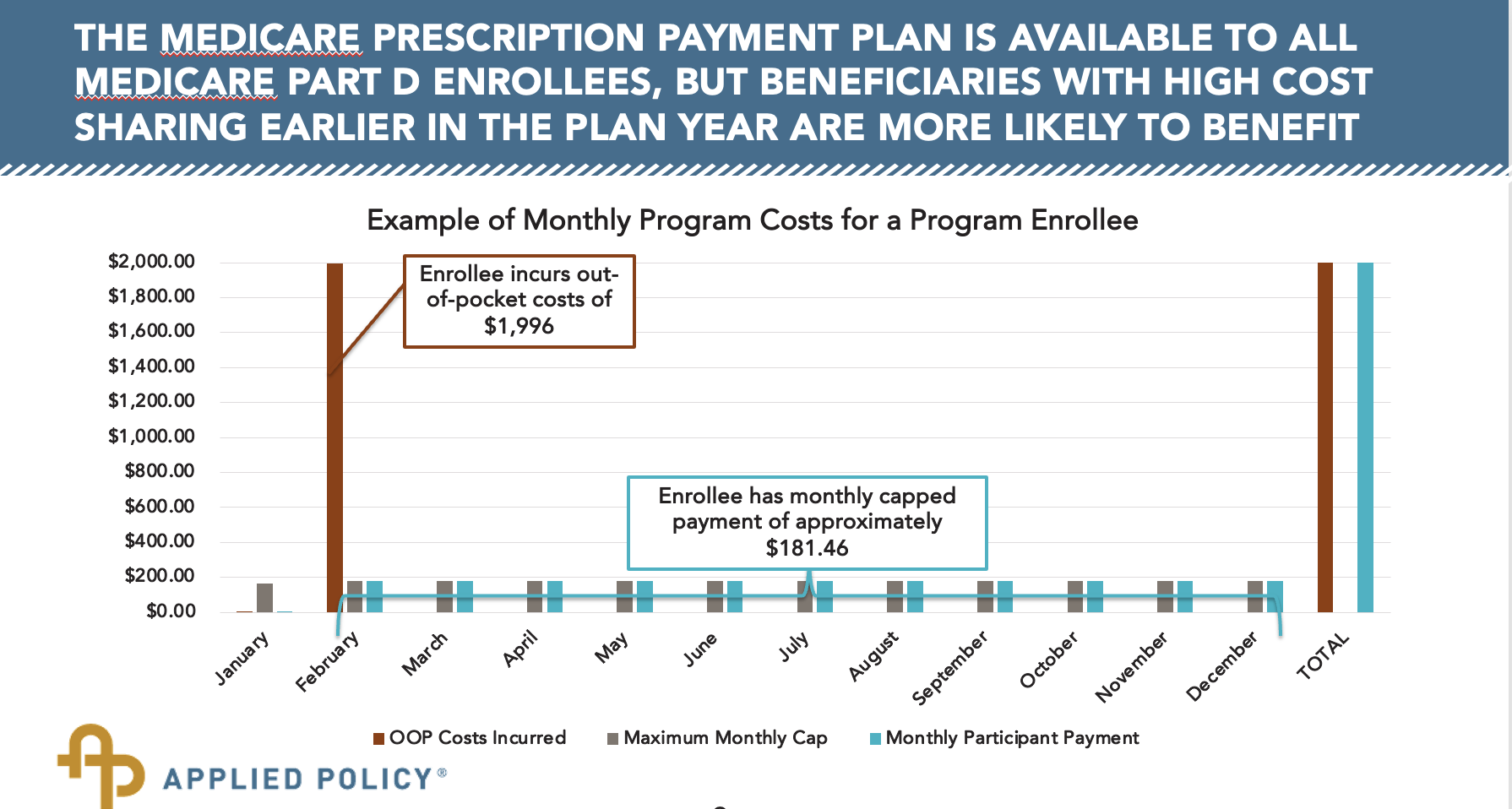

The Medicare Prescription Payment Plan, is a voluntary program launching in 2025, designed to further ease the financial burden on Medicare beneficiaries. Under M3P, enrollees will pay $0 at the pharmacy when they fill a prescription. Instead, their OOP costs will be distributed into monthly payments throughout the year. This will be particularly beneficial for those beneficiaries with high upfront costs early in the year.

The success of M3P will heavily depend on effective implementation and robust beneficiary education. Clear communication will be crucial to ensure beneficiaries understand how to opt into the program and manage their payments.

Operational Details and Guidance from CMS

The Centers for Medicare & Medicaid Services (CMS) is handling the implementation of the Medicare Prescription Payment Program through a series of guidance documents rather than formal regulations. The guidance has been issued in two parts: the first part, focusing on plan sponsor requirements, has been finalized, while the second part, concerning education and outreach, is still in draft form. We expect the final part two guidance as well as new model materials for the program this summer. The earliest opportunity for enrollees to opt into the program is during open enrollment in the fall when they can elect to participate in the program starting at the beginning of 2025.

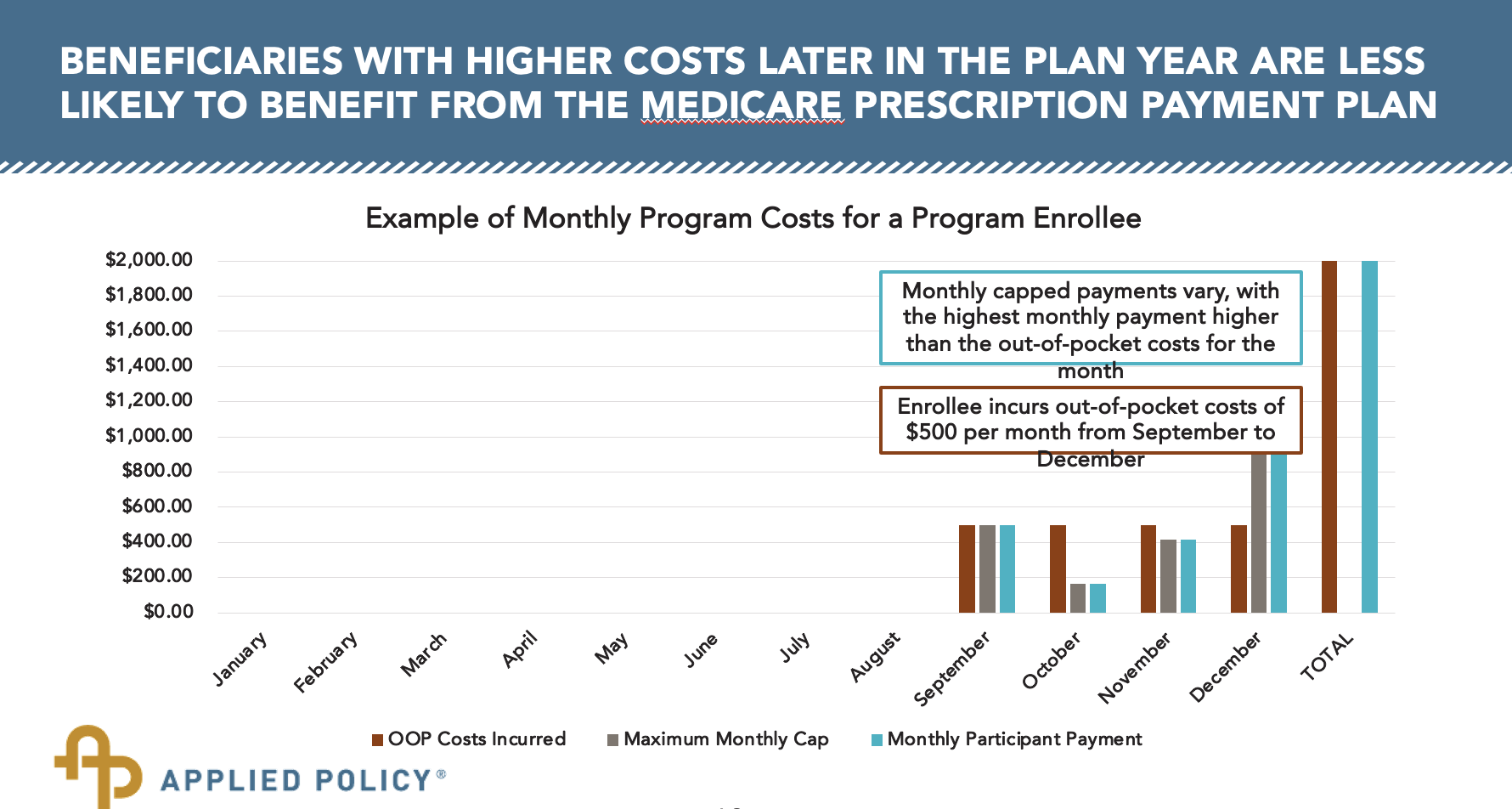

CMS has provided illustrative scenarios in guidance to help beneficiaries understand the potential benefits of M3P. For instance, an enrollee with high upfront costs in January would find their expenses spread evenly over the year, avoiding a large one-time payment. Conversely, for those with higher costs later in the year, due in part to a changing calculation of a cap in monthly out of pocket spending, may have unpredictable payments and a high bill in December (often not a great time for added costs!).

Beneficiaries do not have to opt in at the beginning of the year; they can elect in at any point during the year. There is a timeline prescribed for their enrollment: before the plan year, it must be processed within 10 calendar days, and during the year, it must be processed within 24 hours. Enrollees who have opted in are not stuck in the program and can opt out at any point. After opting out, they would pay any new OOP costs directly to the pharmacy.

Responsibilities and Processes

M3P introduces new responsibilities for Part D plan sponsors, pharmacies, and enrollees:

1. Plan Sponsors: They must identify enrollees who are likely to benefit from M3P and communicate with them about the program. They must also process elections, notify pharmacies of enrollees that may benefit from the program, and manage monthly billing for OOP costs.

2. Pharmacies: When notified by plan sponsors, pharmacies must inform enrollees that they may benefit from M3P and provide a standard “likely to benefit” notice.

3. Enrollees: Beneficiaries can opt into M3P at any time during the year, with enrollments processed within 10 days before the plan year or 24 hours during the year. Those who opt in pay $0 at the pharmacy and spread their costs over monthly payments.

Future Considerations and Flexibility

While many program parameters are set by statute, CMS retains flexibility in implementation. Future adjustments might include real-time election mechanisms, changes to the point-of-sale threshold, and alternative claim processing methods like pre-funded cards. These adjustments will be informed by ongoing feedback and operational experiences.

Conclusion

The introduction of the OOP cap and the Medicare Prescription Payment Program marks a significant shift in Medicare Part D. These changes have real promise to enhance affordability and access for millions of beneficiaries, though they come with challenges and complexities that will need to be carefully managed. As we move toward the 2025 implementation, continued engagement and education will be key to maximizing the benefits of these transformative policies.